arizona real estate tax records

Any person that wants to pay on behalf. Looking for FREE property tax records assessments payments in Arizona.

Tangible Personal Property State Tangible Personal Property Taxes

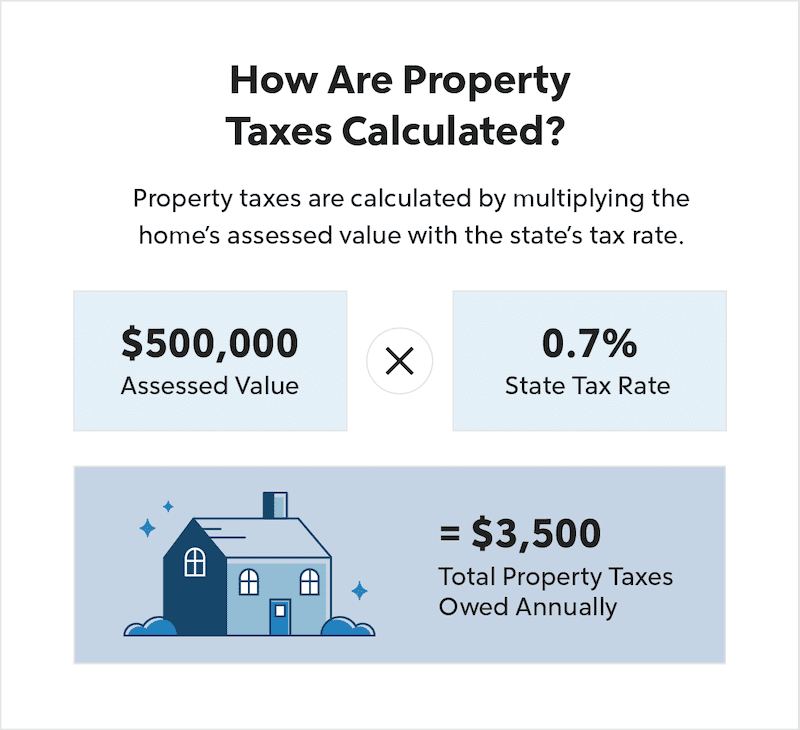

Use our free Arizona property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and.

. View information about 8160 S Hardy Dr Tempe AZ 85284. See if the property is available for sale or lease. The total amount that will be billed in property taxes.

Information on the propertys zoning links to an interactive map and. Pursuant to Arizona Revised Statute 42-18151. The alpha letter can be upper or lower case.

View the history of Land Parcel splits. Work to improve the property tax laws in the State of Arizona. This is higher than the average in Arizona which is 106.

By the end of September 2022 Pima County will mail approximately 455000 property tax bills for the various property taxing jurisdictions within the County. Public Property Records provide information on land. The Yuma County Property Tax information site ITAX has been replaced by new sites from the Yuma County Assessor and Treasurer.

Stone Avenue Tucson Arizona 85701 Please contact our office at 520-724-8630 should you require a hardcopy to be mailed to you. The filter information may include partial entries. The Gilbert AZ property tax rate is 133.

Find information about a property by entering the address or assessors parcel number APN in the search field below. A Arizona Property Records Search locates real estate documents related to property in AZ. An amount determined by the Assessors office and is used in the calculation of the tax bill of a.

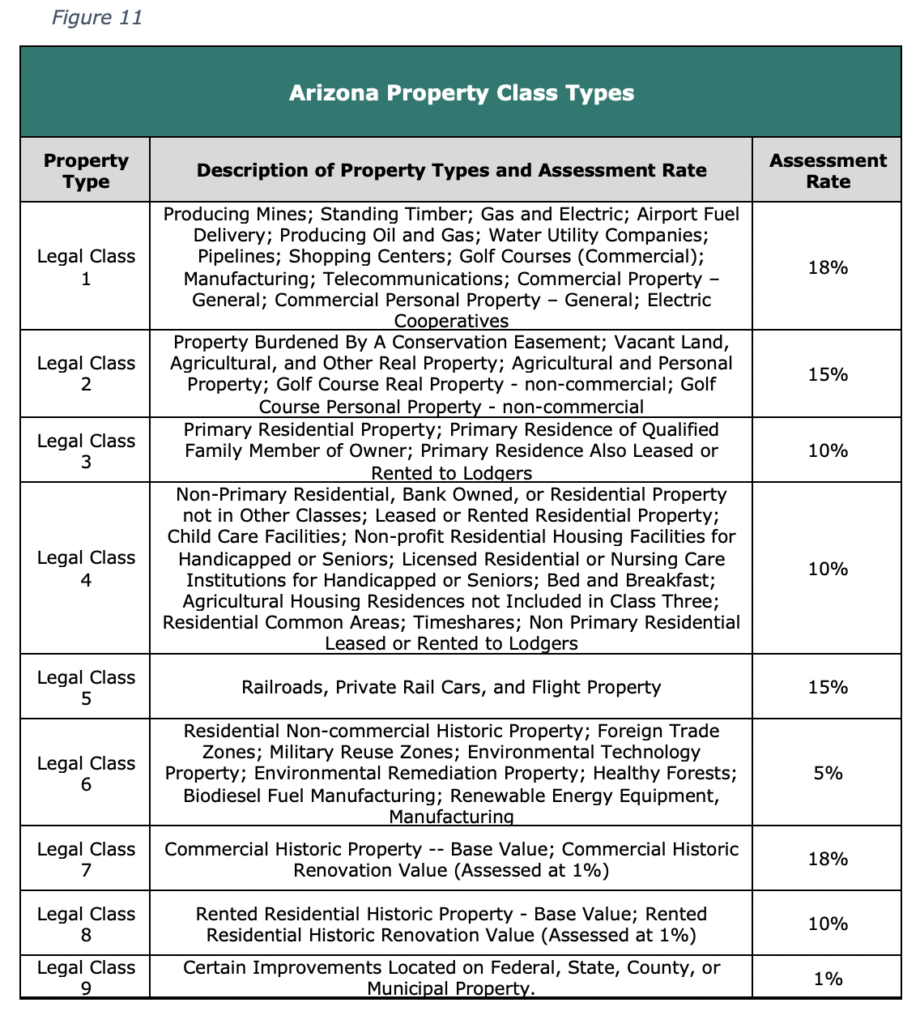

AGRICULTURE APPEALS BUSINESS PROPERTY PERSONAL COMMON AREA FORMS HISTORIC PROPERTY TAX RECLASSIFICATION MOBILE HOMES ORGANIZATIONAL. Explanation of Parcel Number. We will treat everyone with respect compassion and dignity and will be guided by the principles of.

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the. Search the tax Codes and Rates for your area. 672022 2nd Installment Due.

View all options for payment of property taxes. Please use Last Name First Name format in your search. If it is a person.

If no results are found try providing less. Find Arizona Property Records. 1st Installment Due.

The Gilbert tax rate is also higher than the national average of 097. Arizonas average effective property tax rate is 062 which is lower than the national average of 107. All records matching your criteria will be returned.

Pima County Assessors Office 240 N. The last ninth digit and dashes are not necessary to. Please follow the links below to access Property Tax.

We created this site to help you to. Quickly search tax records from 152 official databases. Annual property tax is around 1578 allowing Arizona homeowners to save a lot.

Enter only the first eight numbers of your parcel followed by the alpha letter if one exists. Enter your parcel search filters below. Search by Owner Name OR Mailing Address.

972022 Last day to pay to avoid Tax Sale. View photos public assessor data maps and county tax information. A real property tax lien that is sold under article 3 of this chapter may be redeemed by.

2021 A Record Breaking Year For Real Estate Transactions Corelogic The Power Is Now

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Village Land Shoppe Flagstaff Property Taxes Coconino County Taxes

356 M S V A 77 The City Of Tucson Arizona Employs People To Assess The Value Of Homes For The Purpose Of Establishing Real Estate Tax The City Course Hero

Maricopa County Assessor S Office Mcassessor Twitter

Property Taxes By State How High Are Property Taxes In Your State

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Tucson Real Estate Tax Attorneys Tax Assessments Stubbs Schubart P C

Unclaimed Asset Owner Location Efforts Arizona Department Of Revenue

Why My Arizona Property Tax Bill And Probably Yours Too Increased This Year

Free Real Estate Purchase Agreement Rocket Lawyer

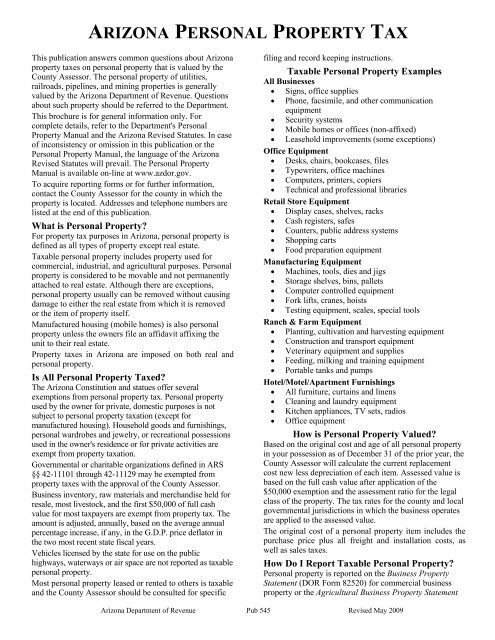

Arizona Personal Property Tax Arizona Department Of Revenue

What Is A Real Estate Transfer Tax And Do I Have To Pay It In Arizona Law Office Of Laura B Bramnick

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation